It’s the microfinance bête noire. The great unspeakable. The furtive shadow slinking down the narrow alleys of poverty. Yes, the consumer loan. Has microfinance really come to this, we ask? Helping the poor buy a TV? Charging 40% interest for the couch to go in front of that TV? And what about family celebrations, festivals, dowries? Is that really what microcredit is for?

Consumption lending has been creeping out from the shadows for some time, but mostly for “good” consumption like school fees, urgent medical care, or basic needs like food during those difficult periods when income is scarce. Still, for many of us the TV-on-credit notion that represents what is so easy to think of as “bad” consumption remains too painful an idea to swallow.

But how to draw the line? If not the TV, then what about a microwave? A motorbike? Plumbing in the home? Is there a framework one can use to evaluate when consumer credit is acceptable and when it is not? No less importantly, how does an institution dedicated to serving poor customers decide what type of funding mechanism – savings or credit – is more appropriate for a given purpose?

There is an important school of thought in economics that holds these questions to be largely irrelevant. The argument is that the consumer is best placed to make her own financial decisions. The responsibility of the institution is simply to provide a sufficiently broad array of financial tools to support the client’s decisions, and, in the case of credit, to ascertain that the borrower has sufficient means to repay.

That is not the premise of this article. While I would not suggest that lenders play Big Brother to their customers, passing judgment on each of their financial decisions, neither do I believe that institutions have no role to play in guiding customer behavior. We are all regularly bombarded by advertising seeking to influence our spending decisions, regardless of whether they leave us better or worse off. Why shouldn’t socially-motivated institutions use the same methods to nudge clients towards better financial decisions? And financial institutions already influence their clients. A lender promoting education loans is encouraging very different behavior than a depository promoting a commitment savings account to pay for the upcoming semester’s school fees, despite the fact that they’re both ultimately serving the same purpose – helping clients pay for school.

A framework for appropriate consumer finance

The purpose of this post is to provide a framework to guide financial institutions in their product design and client education decisions when they want to steer their clients towards better financial management. Many institutions have signed up to the Smart Campaign’s principle of appropriate product design, whose main objective is to do no harm. The appropriate consumer finance framework goes one step further, helping financial institutions design products that are optimized for a given financial need.

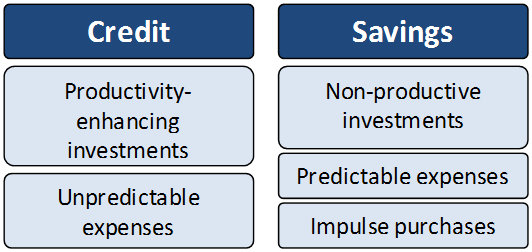

The foundational idea behind the framework is that in consumer finance, the default funding preference should always be savings, unless there is clear justification for why credit would be better suited. Stuart Rutherford’s savings-credit parallel (saving-up in the case of savings and saving-down in the case of loans) demonstrates that the cash-flows of both approaches are essentially the same. The obvious difference, of course, is that borrowing allows the benefit of immediate spending, though at a cost. Interest is naturally part of that cost, but so is credit’s constant companion: the risk of over-indebtedness, which increases with growing levels of debt. After all, future income is never fully certain, but loan repayments are. As a result, for each spending decision, credit should demonstrate sufficient advantages over saving to overcome the added risk and cost.

There are two main types of expenditure for which credit should be the preferred vehicle over savings (Figure 1). The primary one is when the object being funded can significantly increase household productivity. As with business investment, the metric here is straightforward: if the opportunity cost engendered by the delay required to save-up the needed sum exceeds the cost of credit (both in terms of interest and risk to the borrower), then credit should be the preferred vehicle.

The second type of expenditure where credit is preferable to savings is unpredictable expenses. This category is not really about finance but psychology. Saving for unpredictable expenses, such as medical care, seems to be more difficult than for predictable ones, such as school fees. That makes credit a critical tool for dealing with emergency spending needs. But emergency is a relative term, and the immediate availability of credit makes it also a perfect tool for funding impulse consumer goods purchases like the much-maligned television. This problem is best addressed by taking the impulse out of the process, using savings schemes designated for such aspirational but otherwise non-productive goods.

These guidelines for the relative appropriateness of credit over savings should not be over-interpreted. Certainly, there is no reason for financial institutions to dictate or second-guess the spending decisions of their clients. Attempting to regulate client use of financial tools would actually miss the point of the appropriate consumer finance framework. After all, it’s because many institutions have applied overly narrow definitions for appropriate loan use that their customers resort to the casual subterfuge of citing business reasons, when their real intention is to finance household spending needs. Moreover, even the best defined loan criteria can’t account for unique client circumstances – in some cases, buying a television on credit may well be the optimal financial decision.

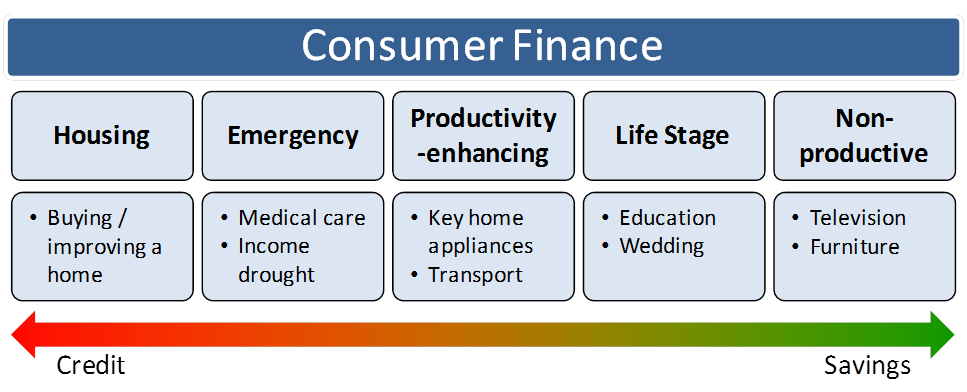

That said, respecting client decisions doesn’t prevent financial institutions from using more subtle methods to gently influence client behavior. To understand how this might work in practice, it’s useful to separate consumer finance into five categories (Figure 2):

Housing has a number of features that set it apart from other consumer spending. Saving for an outright home purchase simply takes too long, while for those without their own home, rental costs absorb significant portion of income, making saving all the more difficult. Meanwhile, the absence of appropriate funding forces many poor families to resort to incremental building strategies, raising a house over a period of many years. This makes the half-completed property usable earlier, but the approach, especially when financed through savings, still misses years of potential household productivity benefits, including better physical security, as well as access to electricity, running water, and sewerage. As a result, credit is nearly always the optimal strategy for financing housing, whether for an outright home purchase or to accelerate the incremental building process.

A house is also a family’s most important long-term asset, and investing in housing can help secure better living conditions well into old age. For the many poor families who rent their homes, this too is a missed opportunity. Finally, housing quality is on its own a core metric for quality of life, making it an important funding objective for socially-motivated organizations.

In today’s microfinance landscape, while a number of MFIs offer housing loans, the actual volumes are essentially negligible, perhaps due in part to the complexity of evaluating and funding larger, longer-term loans. Despite their challenges, housing loans present perhaps the largest virgin territory for expanding financial inclusion.

Emergency expenses are a critical part of consumer credit. It is true that putting away savings for a “rainy day” is a wise choice, its inherent uncertainty (how much? when?) makes such saving difficult and prone to procrastination. Normally, this is a part of the financial puzzle that’s best solved with insurance, though for the sake of brevity, that discussion is better saved for a future post. For the time being, it is sufficient to point out that the appropriate consumer finance framework can be easily extended to include any number of financial vehicles. And credit is and will continue to remain one of the key sources of funding for emergency spending by low-income households – something that is unlikely to change even as microinsurance expands.

The choice of credit for emergency uses makes both intuitive and economic sense. When an emergency strikes, the primary objective is to raise the needed funds quickly, which is the domain of credit. Moreover, many emergency needs also meet the productivity-enhancement test – not getting medical care when needed is very likely to reduce the patient’s ability to work, while simultaneously consuming valuable caregiver time. Microcredit clients already use their loan proceeds for medical emergencies. Financial institutions would do well to recognize this need explicitly and develop more appropriate credit products for the purpose.

Unexpected medical expenses are just an extreme example of what is one of the most common needs in consumer finance – consumption smoothing. For many poor families, incomes come in spurts, but the need to eat is daily. Normally, this would argue for a savings-based approach of funding ongoing household needs, but the frequent unpredictability of income requires the ability to tap into a small, but dependable source of credit, perhaps even a credit line. A loan product along the lines of Grameen Bank’s top-up capability partly answers this need, while P9 from SafeSave enables clients to smooth consumption by both saving and borrowing at the same time.

Productivity-enhancing goods are another segment that has been largely ignored by microfinance providers. The lowly washing machine is arguably the single greatest contribution to household productivity in the modern era, replacing hours of back-breaking labor of hand-washing laundry that women perform week-in and week-out for decades of their lives. And it’s not just washing machines. Organizations focused on improving the lives of women may want to take note that home appliances have been one of the cornerstones in women’s liberation.

The primary obstacle to acquiring a washing machine is not funding, but housing infrastructure: running water, sewerage and electricity (a further argument for supporting housing loans). But even households with these elements in place may still take some years to acquire these time-saving appliances, creating an opportunity for MFIs to nudge their clients with appropriately-designed home appliance loans. And for MFIs with a special focus on the poor, more relevant still may be the funding of basic items, such as the improved cooking stove, which needs no infrastructure, but which has the potential of conveying very real benefits in greater productivity and improved health.

Finally, transport vehicles, such as basic motorbikes, three-wheelers, and other low-cost options meet the test of productivity-enhancement, by broadening access to employment opportunities, competitive markets for food and other goods, and various service providers. Enabling households to acquire reliable transport can increase their access to both higher incomes and more competitively priced goods, while reducing unproductive time spent on travel.

Life stage costs is one area that is often served using credit, but would often be better served via well-designed savings products. This may seem counter-intuitive – after all, education is a highly productive investment. The problem with education is that its payoffs may come decades later and are often experienced slowly over time. In the absence of some type of subsidy that allows lenders to offer long-term education loans, clients often resort to relying on short-term credit to pay for education. But because productivity returns cannot be realized over a short period, such use of credit cannot be justified within the framework of appropriate consumer finance. On the other hand, most education expenses are eminently predictable and are thus perfectly suited for funding via commitment savings, where the payment schedule can be created to perfectly match the required expense when the time comes.

Like education, wedding costs are generally known in advance. However, they don’t generate productive returns in either the short- or long-run, at least not in a sustainable sense. Thus, weddings are likewise better funded via savings. The same is true for other life costs – festivals, rites of passage, and so on. None of these meet the requirements for appropriate consumer credit, but they are all predictable expenses, making them ideally suited for savings products.

Finally, there is the very first life stage expense – birth. Abhijit Banerjee frequently notes in his talks that poor households tend to treat childbirth as an unexpected emergency and fail to save for it even though they presumably know that it is coming. This serves as a perfect example of why the appropriate consumer finance framework should only be used to expand and not constrain consumer options. A forward-looking financial provider might find it appropriate to offer a childbirth savings scheme to women who become pregnant, perhaps with an added baby gift or another enticement. Yet it does not follow that the same institution should deny credit for childbirth to a poor family that had not saved ahead. That would not benefit anybody, least of all the client.

Non-productive goods and services, such as televisions, most furniture items and many other consumer goods are often aspirational goods for low income families. However, they do not provide any direct productivity benefits. Thus, they should not be funded with credit, even though they are frequently purchased that way, often with loans from the retailer or an affiliate institution. Many an MFI client has also funneled at least a part of her loan for such purchases.

There is no need for MFIs to tackle this problem head-on – it is both unnecessarily challenging and even counter-productive for institutions to second-guess borrower spending decisions. However, the issue can be approached indirectly, by providing commitment savings products aimed at acquiring items that clients aspire to own. Most individuals intuitively recognize that buying such goods on credit is not ideal, even if impulse decisions often trump their better instincts. Like a child with a piggy-bank, a consumer already enrolled in a commitment savings plan for an aspirational consumer good, with a maturity date timed to go with a chosen holiday or celebration, will find himself more able to resist impulse buying. The key is to offer savings products specifically tied to a given goal, as opposed to simply providing a generic savings account. That is how our psychology works.

Safely navigating consumer finance

For MFIs that have or are seeking to expand beyond the traditionally narrow scope of microenterprise lending, the framework laid out above can provide guidance for serving low income clients in a way that is appropriate to their needs. Expansion into consumer finance – both credit and savings – should be an important component of many MFIs’ financial inclusion strategy. One often hears the critique that MFIs venturing into consumer lending are losing sight of their mission and taking on risks they don’t understand. But naysayers should recognize that MFIs are already funding consumer spending through their ostensibly microenterprise loans. In fact, the frequent repayment schedule of standard microcredit loans, often starting on week one, is actually closer to consumer credit than it is to business investment loans (and may actually depress microenterprise investment).

Once MFIs recognize that an increase in household productivity is in essence no different than an increase in enterprise income, there should be no reason to refuse one while funding the other. As for managing risk, with due care, those capacities can be developed.

As with credit, so with savings. Many MFIs have employed only basic savings products, often in the form of time deposits. Better tailored accounts, especially those linked to specific needs – such as school fees or aspirational consumer goods – would help clients reduce the cost and risk for funding planned expenses, while also supporting better financial decision-making.

The key is to maintain an understanding of what constitutes appropriate consumer finance, and design and market products accordingly. Hopefully the framework set out above will prove a useful guide in that process.

Thanks for giving such a excellent tips for consumer finance…everyone can go in a right way with secure future….