Co-authored with Vikash Kumar; MicrofinanceFocus, 12 May 2010

SKS Microfinance, India’s biggest lender to the poor, is soon to become the nation’s first microfinance company to list on the Stock Exchange. In the past 10 years, it has evolved from an NGO to a public limited company and has set many benchmarks for the industry to follow. Microfinance Focus presents a comprehensive look at this journey, tracing it from the company’s roots in the late 90s through the final months leading up to the IPO.

Editor’s note: this article is based on published sources, including the SKS Draft Red Herring Prospectus, as well as numerous exclusive interviews with individuals closely familiar with different aspects of SKS, many of whom spoke only on condition of anonymity. Depending on the nature of the confidentiality requested, some sources may not cited at all. However, we have included only such information that could be independently verified.

The Foundation

Started in 1997 as a public society in the form of an NGO, Swaya Krishi Sangam (also known as SKS Society or SKS NGO) went on to transform itself into the largest MFI in India and the fastest growing MFI in the world, as of September 2009 reaching 5.3 million poor women, or some 20% of all MFI clients in India.

After several years of operation as an NGO, SKS Society found itself constrained by the not-for-profit business model. In response to the growing demand of microfinance, SKS Society created a private company, SKS Microfinance Private Limited in 2003, which became a Non-Banking Financial Company (NBFC) in 2005. Finally, in May 2009, the Company was converted into a public limited company.

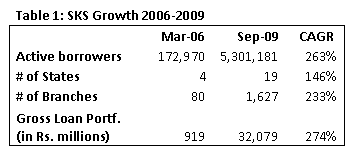

This transition from an NGO to a public limited company allowed SKS to achieve and sustain a level of growth that is unprecedented in the history of microfinance, both in India and anywhere else. In the 3½ year period from March 2006  to September 2009, SKS recorded cumulative annual growth of around 250% across multiple categories (Table 1). Meanwhile, its profit margins continued to increase, with return on equity growing from 5.1% in FY2007 to 18.3% in FY2009.

to September 2009, SKS recorded cumulative annual growth of around 250% across multiple categories (Table 1). Meanwhile, its profit margins continued to increase, with return on equity growing from 5.1% in FY2007 to 18.3% in FY2009.

The Business Model

Since at least 2003, SKS has been focused almost exclusively on developing a model that could scale rapidly. As a result, the company has long used outreach – the number of poor people reached and the number of loans granted – as the key measure of its success. It has achieved this by constantly overcoming constraints to scaling that are present in microfinance. To insure a sufficient supply of capital, it was the first Indian MFI to raise purely commercial equity; to build capacity, it has adapted scalable processes from the business world and applied them in the microfinance context; and to reduce costs, it has extensively invested in technology.

Given the high-touch nature of microfinance, SKS staff growth has paralleled that of its portfolio. On its own, such growth presents significant difficulties, but SKS has also been continuously dealing with significant employee turnover – an average of 25% – such that, after combining this with the rapid growth, the result is that any given time, some 75% of the staff has been with SKS for less than 12 months. While official numbers are not available, one individual with knowledge of the situation reported that the challenge posed by large numbers of new staff is an issue not just in the field, but also at the headquarters. Nevertheless, productivity remains high – each of its loan officers is responsible for an average of some 450 active borrowers (or 550 clients).

SKS has also invested heavily in standardizing its operations, basing them on an extensive MIS. In fact, it was among the first Indian MFIs to invest heavily in technology as a means of supporting growth and driving productivity. Thus, it might not be surprising that among its early investors, one finds many luminaries from the IT world: Vinod Khosla, co-founder of Sun Microsystems; Sequoia Capital, an investor that counts Cisco, Apple and Google among its early-stage investments; and Unitus, a microfinance investor based in Seattle (the home of Microsoft) whose board and executive staff is filled with former IT executives.

This standardization thus far has implied an almost exclusive focus on traditional group-based microcredit loans – just two of these loan products account for 98.5% of SKS portfolio. At the same time, the company has engaged in tie-ups with insurance companies, most successfully with Bajaj Allianz with which it sold 2.4 million life insurance policies. More recently, SKS has been piloting partnerships with Nokia, Airtel, and Metro. However, to-date, these tie-ups have not been a major income source: while microcredit operations account for 89% of revenue, insurance commissions and related fees account for only 5%. The remainder comes from interest on bank deposits.

When it comes to financing its rapid growth, SKS has been one of the first MFIs to actively engage the commercial finance market, especially in the private equity space. The frequency of these capital raises was also unprecedented in the microfinance sector, with five distinct capital raises since 2006 and each successive deal larger than the first. However, at the present, SKS has reached a stage where further private equity raises have become a limiting factor, pushing it to seek funding from the larger public markets, by way of the IPO.

The Trust

The SKS Mutual Benefit Trusts (MBTs) have been a core component of SKS since it began its transformation to a for-profit entity. In essence, the MBTs are the link between SKS Society (the NGO) and SKS Microfinance (the NBFC). In 2003, these five private for-profit trusts were formed by SKS Society with the objective of promoting and enhancing the social and economic welfare of their members. At their inception, these trusts consisted of 500 sangams (SKS village-level groups) in Andhra Pradesh, representing about 16,600 women. In March 2010, the Trust deeds of the MBTs were revised to include 220,000 sangams that are currently part of the SKS network and will eventually represent some 6.8 million women.

MBTs as investors

To capitalize the MBTs, Vikram Akula raised donations which then became the source of the Rs. 2 crore (US$500,000) that the MBTs invested in SKS Microfinance in 2003 to become effectively the sole (99.5%) owners of the new company. In August 2005, having raised its first round of equity from social investors, such as Unitus, Vinod Khosla, SIDBI, and the Reddy Foundation, SKS Microfinance bought the NGO’s microfinance portfolio for Rs. 5.5 crore ($780,000), paying 3.5x over book value. The proceeds were then transferred to the MBTs, which used it to take an additional equity stake of Rs. 4.5 crore ($1.0 million) in SKS Microfinance.

The third and final transaction took place in 2008-9, when Vikram Akula raised another Rs. 1.5 crore ($350,000) from a few US philanthropists. However, the result was an extraordinary transaction, whereby in January 2008 the MBTs were allocated shares valued at Rs. 27.3 crore ($6.1 million), while paying only Rs. 1.5 crore. The remaining cost of the shares was paid only in December 2009 – nearly two years after allocation and only some four months before the filing of the draft red herring prospectus – when Silicon Valley Bank issued a loan to the MBTs, backed by a guarantee from Vinod Khosla, for the remaining Rs. 25.8 crore ($5.7 million). Presumably, the loan was issued with the expectation that it will be repaid following the IPO with the proceeds from the partial sale of the MBT stake.

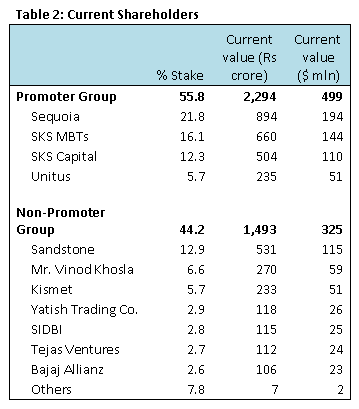

Through these three transactions, the MBTs were able to become the second-largest SKS investor (Table 2), with a 16.1% stake (pre-IPO) valued  at Rs. 660 crore ($144 million) – all for an investment of only Rs. 2 crore originally donated back in 2003 and 1.5 crore in 2008. Most of the rest essentially came from the other SKS equity investors who were effectively agreeing to indirectly fund the MBTs via voluntary dilution of their own stakes. The 2008 transaction is especially notable, since the investors in January 2008 (among them Sequoia Capital – a strictly commercial fund), appear not to have objected to the essentially unfunded allocation to the MBTs at a time when they themselves were paying 71 Rs/share. By the time the MBTs actually paid-up these shares at the original price set two years prior, they were already worth 637 Rs/share, or nine times the price paid by the MBTs.

at Rs. 660 crore ($144 million) – all for an investment of only Rs. 2 crore originally donated back in 2003 and 1.5 crore in 2008. Most of the rest essentially came from the other SKS equity investors who were effectively agreeing to indirectly fund the MBTs via voluntary dilution of their own stakes. The 2008 transaction is especially notable, since the investors in January 2008 (among them Sequoia Capital – a strictly commercial fund), appear not to have objected to the essentially unfunded allocation to the MBTs at a time when they themselves were paying 71 Rs/share. By the time the MBTs actually paid-up these shares at the original price set two years prior, they were already worth 637 Rs/share, or nine times the price paid by the MBTs.

Because this is a transaction of some complexity, a simple analogy might be helpful: consider five friends who decide to pool their money and invest in a mutual fund. One of them doesn’t have enough money to contribute, but the others invite him to join anyway, so long as he pays them back in the end. Four friends contribute Rs 1000, and the fifth invests only Rs 50, for a total of Rs 4050. After two years, the fund has grown nearly 10 times, and the friends cash out, dividing Rs 40,000 into even shares of Rs 8,000. Out if this, the one friend pays the Rs 950 to the other four. The analogy is not identical, but it is essentially what took place with the 2008 equity raise, with the MBTs playing the role of the moneyless friend.

MBTs and SKS Society: an organic link

The upcoming sale of 19% of the MBT stake, which would net Rs 128 crore ($28 million) based on the most recent valuation (final pricing will not be known until the IPO is completed), will constitute a major infusion of capital for the MBTs. Although it has not been publicly disclosed, according to several knowledgeable sources, these proceeds will be directed to the SKS Society. In this way, the circle begun in 2003, when the MBTs for created by the NGO, will be completed.

This is would be a large sum for any NGO, but in the case of SKS Society, a relatively small organization with annual budget around Rs 1.1 crore ($240,000), it represents a sea-change. Indeed, a few knowledgeable individuals have suggested that Vikram Akula is seeking to make SKS Society his next project, in some ways mirroring Bill Gates’ transition to his own eponymous foundation. However, in Mr. Akula’s case, the change is in many ways a return to the early days of Swayam Krishi Sangam, though with more funds and far greater prominence.

In fact, the Society has been preparing to take its place among leading Indian NGOs since spring 2009. At that time, it brought in several independent directors with considerable global reputations in the development sector and no prior affiliation with SKS, including Orlanda Ruthven, a long-time development consultant, and Frances Sinha, co-founder of EDA Rural Systems. SKS Society is trying to position itself as a broad-based development organization, focusing on economic development, health, and especially childhood education in the communities where SKS Microfinance is active, somewhat along the lines of Bangladesh-based BRAC. To assist in the development of this strategy, it retained outside consultants, including PriceWaterhouseCoopers.

One person actively promoting the focus on education is Gurcharan Das, the well-known author and former board member of SKS Microfinance and trustee of the MBTs. Early this year, Mr. Das resigned both these positions to dedicate his time to the SKS Society’s education programs, becoming chairman of the Society’s board in May 2010. “There is so little time in life so one should do few things and should do them well and should do things which are your passion and this is my passion,” said Mr. Das, adding that he seeks to have “a million poor children educated in the SKS school program.” That is an ambitious goal, given that the NGO’s existing education program reaches only 550 children.

Governance of the MBTs

Mr. Das is not the only trustee to have resigned from the MBTs. Two additional persons, Anu Aga of Thermax and Narayan Ramachandran of Morgan Stanley, who, along with Gurcharan Das had all joined as trustees of the MBTs in November 2009, resigned only a few months later. There had in fact been significant differences in views – according to Gurcharan Das and another individual familiar with the situation, the disagreement had centered over the best means to direct the Rs. 650 crore capital base of the MBTs.

The other two trustees argued that providing such a large sum to an organization with only modest operations to-date was not the most effective way to serve the interests of the MBT beneficiaries, arguing that a Ford Foundation model of funding different organizations with existing infrastructure and expertise would ultimately bring greater benefit. Others, including Vikram Akula and the late Sitaram Rao, insisted that a model patterned along the lines of BRAC in Bangladesh would better take advantage of the existing network built by SKS. The second argument prevailed, and the two trustees resigned.

Prior to their resignation and that of Mr. Das, this board did adopt one notable decision. It voted to express its gratitude on behalf of the MBTs for the work of the former CEO of SKS, the late Sitaram Rao, in the form of a gift of SKS stock worth Rs 6 crore ($1.3 million) made to his mother.

Following the resignation of these three trustees, SKS Trust Advisors Private Limited (STAPL) was designated the sole trustee of each SKS MBT. The directors of STAPL currently comprise Vikram Akula and Dr. Ankur Sarin, professor at IIM-Ahmadabad and director of SKS Society, although for Mr. Akula this is expected to be only an interim appointment, until replacement board members are found. The new MBT governance structure also includes representation from the beneficiary member groups.

In fact, from the beginning, the MBTs provided for representation from the sangams via two members of the community who held positions as trustees on the 5-person MBT board. This proved better in theory than practice, since the educational background and experience of these representatives limited their influence in board decisions. Instead, the board elected to hold informal meetings with large groups of SKS clients as forums to discuss the activities of SKS Society and the MBTs. The focus of the meetings was more to communicate the Society’s activities and plans rather than seek explicit input from the women for specific decisions. This structure was formalized with the updated trust deed as of March 2010, where the sangams of each of the five MBTs can appoint up to 100 individuals to represent their interests.

Management Shareholding & Compensation

Besides being the first MFI IPO in India, SKS has another unusual distinction – its management is not among the promoters. Indeed, neither Chairman and Founder Vikram Akula nor CEO Suresh Gurumani own any significant direct stakes in SKS. As a result, this has led the company to take the unprecedented step for Indian IPOs: having its private equity investors, including Sequoia – a venture capital company – serve as promoters for the purpose of the IPO.

Notwithstanding his lack of direct shareholding, in the lead-up to the IPO, Mr. Akula owned significant stock options granted as compensation in 2007 and 2008, which if exercised, would have comprised about 5.3% of pre-IPO capital, with a net value of Rs. 168 crore ($36.4 million). In February 2010, Mr. Akula sold 26% of his options, realizing a profit of Rs. 55 crore ($11.9 million), while voluntarily locking in the remainder for a period of three years. As it happens, this transaction largely mirrors those of the promoters, each of whom is selling a 20-30% of their stake and locking in the rest, as mandated by SEBI rules.

In Mr. Gurumani’s case, his stock options were granted when he joined the company in December 2008, and currently have a net value of Rs. 30 crore ($6.6 million). Like Vikram Akula, Mr. Gurumani has also opted for selling 25% of his options, realizing a net profit of Rs. 7.6 crore ($1.6 million) and locking in the remainder.

In fact, while the stock option plans (both ESOP and ESPS) have been primarily designated for the two executives, Akula and Gurumani, who were allocated 50% of the options issued under these plans, SKS has also used options as employee compensation. With the other members of the executive team, M.R. Rao and S. Dilli Raj, receiving a further 8%, the remaining 42% was allocated based on a combination of tenure (minimum 2 years) and level of responsibility, covering in all some 25% of SKS staff.

Executives and staff were not the only recipients of stock options. Beginning in 2008, five independent directors of SKS have also been allocated options, with a current net value of Rs. 6.5 crore ($1.4 million). None of these options have been exercised to-date.

The Soul Searching

The announcement of the SKS IPO has brought back many of the divisions precipitated by the 2007 IPO of Compartamos in Mexico. The modern-day founding fathers of the industry – Prof. Mohammad Yunus, Sam Daley-Harris and others – have again raised concerns about how such commercialization undermines the mission of microfinance, emphatically rejecting what they regard as growing “profiteering.” Mr. Yunus minces no words: “when you put an IPO, you are promising your investors that there is a lot of money to be made and this is a wrong message.” Mr. Daley-Harris is more circumspect and doesn’t eschew working with capital markets: recalling a $180 million securitization by BRAC in 2006, he emphasizes that, in the end, the key is to remember the mission. However, he is skeptical of the SKS IPO: “How much of the SKS IPO will be going into the loan portfolio? It seems like it’s a lie.”

The non-profit or social-business models of BRAC and Grameen Bank are not easily found in India. Why this is so isn’t entirely a question of choice – the legal frameworks in Bangladesh and India are also important determining factors. For example, Grameen Bank in Bangladesh is funded primarily by deposits raised from its own borrowers and non-members, whereas Indian MFIs are prohibited by law from collecting deposits. For them, funding must come from outside by necessity. Given the magnitude of demand – by one widely-cited measure, as much as Rs. 2.1 lakh crore ($40 billion) for micro-credit – the only sufficient external sources to provide that are the commercial capital markets. And the larger the MFI, the more broad-based the source of funding – in a recent Business Outlook India article, Vijay Mahajan, founder and chairman of Hyderabad-based MFI Basix, claims that “an IPO is inevitable for any NBFC-MFI that has reached Rs. 3,000 crore (US$650 million) in its loan portfolio.”

Aside from scale alone, there is also the question of growth. Bangladesh is the most widely-served microfinance market in the world, with some 16% of its population counted as microfinance clients. It has also had the benefit of having 30 years to get to this stage. Given the far larger numbers of poor in India, rapid growth is not just an MFI promoter’s dream – it is a necessity if one is to reach the countless villages across the country that are yet to see a single MFI. And SKS sets the benchmark for growth – where Grameen Bank took 30 years to reach 6 million clients, SKS took only 6.

Whether hyper-growth or profit are antithetical to remembering the mission is a different question, and one that is not yet settled. In an impassioned essay in Microfinance Focus, P.N. Vasudevan, founder and CEO of Equitas – the fastest-growing MFI in India last year – argues that being for-profit in no way contradicts the client-focused mission, inviting any critic “to spend a day with us and then declare that not-for-profit format is the only way of being mission focused and I promise to quit my organization.”

Only time will tell which side is right.

Leave a Reply