MicrofinanceFocus, 17 Nov 2009

By most standards, microfinance is a young sector, and in many countries it can be said to still be in its infancy. Yet its continuing spectacular growth, especially in India, should give one pause – every time promoters celebrate another multi-million-client threshold, I wonder – how many more such thresholds are left? How do we know when we’ve arrived?

This is not a philosophical question – normally, markets send signals. New customer demand drops. Prices fall. Margins decrease. However, credit markets are funny animals – the hopeful, exuberant part of our human nature dictates that, when presented with the opportunity, we tend to overestimate our repayment capacities and borrow beyond our means. And when we can borrow from one lender to repay another, we can stretch the cycle out even further. The market signal gets delayed, while a bubble builds – when the signal does come, it is in the form of the bubble bursting. Students of the US housing crisis can tell you – it is a most unpleasant signal to receive. I vividly remember the day in January 2007, when I first learned of the unusual delinquency patterns emerging in the US subprime market – at the time this affected only a small proportion of loans within a relatively small subsector of the mortgage market, and few thought then that this presaged a crisis that would engulf the entire mortgage market, let alone the global economy. Yet even though subprime lending had subsequently all but vanished by spring of 2007, it could not prevent the worldwide tsunami from crashing down nearly two years later. Such is the nature of bubbles.

The trouble is, determining whether we are actually in a bubble is no easy task. A look at the US stock bubble of the late 90s and the housing bubble of ’04-07 shows a familiar pattern – the eager participants are hypnotized by the glitter of their apparent success, the “wise seers” seek ways to explain visible deviations from the norm, while the few lone voices calling for a time-out are made outcasts of society. Yet when the bubble finally bursts, everyone adopts the common refrain: why didn’t “they” (the government, the corporations, the media) do something – the bubble was so obvious!

Estimating Microfinance Market Capacity

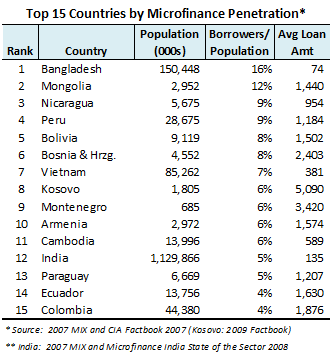

One way to determine whether there is a bubble in microfinance is to ascertain market capacity (number of potential microfinance clients), then compare that to actual  penetration. However, determining capacity is hardly an obvious task. In 2006, in outlining their vision for the next ten years, Rhyne and Otero included a table with a simple ratio of borrowers/population. Back then, Bangladesh had a 9.2% penetration, and the authors suggested that that may be “an upper bound for very large national penetration of microfinance.” Here’s the same table three years later. Note that since then Bangladesh has grown over 60% in penetration, while three additional countries have either reached or breached the boundary suggested by Rhyne and Otero. But what do these numbers tell us? If 9% penetration is not the upper bound, maybe 16% is? Or perhaps 30%? To get a better idea, I created a simple model for estimating the upper bound of market capacity. This is only a crude model – a more robust version would require more detailed market data, however it still provides useful insight.

penetration. However, determining capacity is hardly an obvious task. In 2006, in outlining their vision for the next ten years, Rhyne and Otero included a table with a simple ratio of borrowers/population. Back then, Bangladesh had a 9.2% penetration, and the authors suggested that that may be “an upper bound for very large national penetration of microfinance.” Here’s the same table three years later. Note that since then Bangladesh has grown over 60% in penetration, while three additional countries have either reached or breached the boundary suggested by Rhyne and Otero. But what do these numbers tell us? If 9% penetration is not the upper bound, maybe 16% is? Or perhaps 30%? To get a better idea, I created a simple model for estimating the upper bound of market capacity. This is only a crude model – a more robust version would require more detailed market data, however it still provides useful insight.

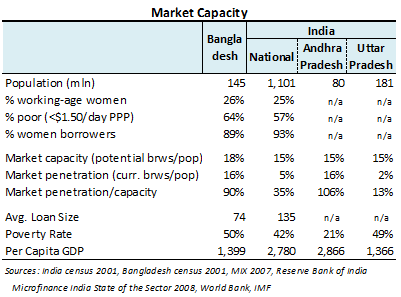

The model is presented below – it uses the same borrower/population metric as above, with additional adjustments for three factors (the full sourcing and description of the assumptions is provided in the excel file at the end of the article):

- Gender – since microfinance lending is mostly to women,

- Age – to exclude the very young and very old, and

- Wealth/financial access level – to exclude those outside the MFI target market. The $1.50/day measure is a close equivalent of the widely used figure of 600 million poor in India.

In addition to the assumptions buried in these three components, there are two additional issues that the model doesn’t capture: first, not all potential borrowers can be actual borrowers, i.e. not everyone needs to borrow all the time; and second, multiple borrowing skews the numbers as well, since the same customer gets counted multiple times. Despite these issues, the model can serve as an indicator about what’s happening in the markets and as a tool for identifying potential bubbles.

My calculations show that Bangladesh is fairly saturated, with market penetration approaching capacity. India, on the other hand, is a much more complex picture. It’s  well-known that microfinance penetration in India has an extremely uneven geographic distribution – while its largest state, Uttar Pradesh (and a number of others, mostly in the north), is relatively unserved, the southern state of Andhra Pradesh (AP) and its neighbors show a very different story. Frankly, the numbers there concern me – AP has more microfinance clients than any other country in the world except for Bangladesh; it shares the distinction as the most penetrated market in the world, on par with Bangladesh; and most disquieting, the state was already at 6% over-capacity a year ago (the table uses 2008 data). Explaining these numbers without allowing for extensive multiple borrowing is indeed a challenge.

well-known that microfinance penetration in India has an extremely uneven geographic distribution – while its largest state, Uttar Pradesh (and a number of others, mostly in the north), is relatively unserved, the southern state of Andhra Pradesh (AP) and its neighbors show a very different story. Frankly, the numbers there concern me – AP has more microfinance clients than any other country in the world except for Bangladesh; it shares the distinction as the most penetrated market in the world, on par with Bangladesh; and most disquieting, the state was already at 6% over-capacity a year ago (the table uses 2008 data). Explaining these numbers without allowing for extensive multiple borrowing is indeed a challenge.

Frankly, I think this is about the strongest evidence of a bubble one could hope to find using publicly available data. When coupled with the current repayment crisis in several districts in the neighboring state of Karnataka (which has similar penetration numbers as AP), it also becomes difficult to ignore. The most commonly used arguments against the bubble theory in south India – that the isolated districts in Karnataka represent only a slither of the microfinance market and repayment rates remain otherwise high – shows only that the bubble hasn’t yet burst, not that it doesn’t exist in the first place. Another argument that has been advanced by Vikram Akula in his letter to the editor of the Wall Street Journal is that multiple borrowing is not a cause for concern, citing as evidence the Karuna Krishnaswamy 2007 study that found multiple borrowers have equal or better repayment rates compared to their single-borrower counterparts. Since multiple borrowing is a core element of what I argue is an existing bubble, a bit of discussion on the subject is warranted.

Conducted during a period of high economic growth in India, the Krishnaswamy study found that multiple borrowers, representing 7-10% of clients in his sample, consisted primarily of highly motivated entrepreneurs seeking to raise more capital than what was offered by any one MFI. This is unsurprising – due to the nature of their cycle-based lending model, MFIs knowingly underfund their borrowers, thus assembling funds from multiple MFIs is a logical strategy that Krishnaswamy suggests is simply a replacement for the informal funding sources the individuals would have tapped otherwise. This is also consistent with the money management practices documented by Collins et. al. in Portfolios of the Poor. However, as the market heats up and multiple borrowing becomes increasingly widespread, the number of multiple borrowers grows beyond these stand-out individuals – just a few months ago on the CGAP blog, N. Srinivasan stated that 25% of borrowers in urban and peri-urban areas have 5+ loans, while 3 loans is the average for all borrowers in these areas. The immediate risk is that some of these borrowers may be falling into a debt spiral, borrowing from one MFI to repay another. However, the less immediate but greater risk is that increasingly many clients are carrying debts that leave little room for absorbing even relatively moderate economic shocks. Multiple lending on such a large scale has a minimal track-record, and the examples that exist (e.g. Bolivia in 1999) should not inspire imitation. By ignoring clients’ outstanding debts, MFIs in India and elsewhere are abandoning their responsibility for prudential lending.

What Does the Future Hold?

Let me state upfront that even if one accepts the existence of a significant microfinance bubble in South India, that doesn’t guarantee that Andhra Pradesh or any other geographic area is bound to have a crisis. However, I would argue that these areas show vastly increased sector-wide risk, and thus, significant probability of a large-scale crisis. In fact, the Krishna district in AP already had a repayment crisis in 2006, and though many attribute it to political interference, a number of voices have pointed out that politicians were tapping into existing borrower resentment towards the MFIs – after all, it’s hard to inflame a happy crowd. Moreover, among the other countries with high microfinance penetration, Bosnia and Nicaragua are already undergoing repayment crises. Given these examples, risk managers should heed carefully the community aspect of microfinance, which makes the sector so effective during normal times yet can also turn what otherwise would manifest as default spikes into en masse defaults that can engulf entire countries. The normal rules of risk management don’t apply then – of all their problems, the one US banks don’t have to deal with is heavily distressed American borrowers taking to the streets demanding cancellation of their debts.

As I had stated earlier on, it is impossible to prove that a bubble exists while one is still in it – the best one can do is point to data that suggests it may be happening. I can’t predict whether the microfinance bubble I believe exists and continues to grow in Andhra Pradesh and other south Indian states will deflate quietly or burst spectacularly. The outcome depends partly on luck and exigent circumstances, and partly on the actions of the MFIs themselves. In their pursuit of growth, many MFIs have continued to add large numbers of new customers in Andhra Pradesh and other highly saturated regions – I believe that is irresponsible. While rapid growth in the north is a commendable strategy for continuing expansion of financial access, pursuing the same in the south (with the exception of remote, still unserved areas) puts short-term gain not only above the long-term financial soundness of the sector, but, more importantly, above the long-term interests of the very poor the MFIs are seeking to serve. The spark that sets off a large-scale delinquency crisis can be anything and could come at any time – a rapid drop in economic growth, a populist political movement, a religious decree, or a collections effort gone bad. One can’t control the spark, but one can control how much fuel that spark can ignite.

With microfinance, we can’t afford to hope that there will be no spark. For when it does come, I’ll shed no tears for investor losses, nor for MFI managers’ pain – it’ll be the global unbanked poor who I fear will find themselves without financial access once again. India is no Bolivia – if the bubble bursts there, the entire global microfinance sector will find itself reeling. When the media swoop in for their favorite headline buzzwords, and the killer banes of illiquidity and capital flight seize the sector, there will be no rescue from development agencies then. Instead, one will hear the righteous indignations of politicians decrying “deceptions” and “manipulations”. And they will be right – microfinance rests on its reputation as a socially motivated industry, and when the biggest market in the sector comes crashing down from a crisis of its own making, it’ll bury that reputation and the rest of the industry with it.

[…] Daniel Rozas warns, I listen. Rozas forecasted the crisis of microfinance which broke out in India in late 2010, warning as early as November 2009 […]